17+ Mortgage interest

15-year fixed-rate mortgages. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

Bpcgmu3 I Gvdm

A few weeks after my first by-line share markets around.

. This time last week the 30-year fixed APR was 600. For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time last week. The Mortgage Bankers Association predicts in its latest Mortgage Finance Forecast that 30-year fixed rates will remain above 5 for most of 2022 before declining slightly to 48 in 2023.

Mortgage interest rates are normally expressed in Annual Percentage Rate APR sometimes called nominal APR or effective APR. The average APR on a 15-year fixed-rate mortgage rose 10 basis points to 5343 and the average APR for a 5-year adjustable-rate mortgage ARM fell 7 basis points to 5307 according to rates. Mortgage Interest Rate forecast for June 2023.

Mortgage rates grew for the fourth week in a row and broke 6 for the first time since 2008. The 15 Year Mortgage Rate forecast at the end of the month 630. APR is the all-in cost of your loan.

This excludes mortgage loans with interest offset features and overdraft facilities. Experts are forecasting that the 30-year fixed-rate mortgage will vary from just above 5 to as high as 7 by the end of 2022. Here are their more detailed mortgage interest rate predictions for 2022.

At an interest rate of 555 a 30-year fixed mortgage would cost 572 per month in. The average APR for a 30-year fixed refinance loan increased to 619 from 605 yesterday. This is the first time since.

So if a homeowner with a 200000 mortgage takes on a 30-year fixed-rate mortgage with a 4 interest rate he or she would pay about 343700 in total over the loans life. The average 30-year fixed interest rate rose from 5. The bonus interest will apply for 12 months.

The 30-year fixed-rate mortgage averaged 416 in the week ending March 17 up from 385 the week before according to Freddie Mac. Mortgage rates took another big leap this week. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

Homeowners who bought houses after Dec. It is the interest rate expressed as a periodic rate multiplied by the number of compounding periods in a year. The new Citi Interest Booster hurdle account offers up to 28 pa.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017. 30-Year Mortgage Rates. Mortgage rates climbed past 4 for the first time since May 2019.

Living through 17 interest rates scarred Boomers deeply. This time last week it was 561. How your mortgage interest rate is determined.

Sep 15 2022 1039AM EDT. Thats still nearly double the rate of 286 a year ago. For mortgage rates were likely to see upward pressure with much less intensity.

USDA eligibility and income limits. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The table below reveals how much incremental increases to a tracker mortgage rate can add to an average borrowers monthly mortgage.

Interest but theres very little for miles chasers to get excited about. Mortgage rates are currently near 55 and I. 15 Year Mortgage Rate forecast for May 2023.

The average for the month 617. Youll definitely have a higher monthly payment. Its the most exposed part of the bloc to rising interest rates.

A good rule of thumb is six months of mortgagetax and insurance for loans under 750000 and 12 months for jumbo loans says Melissa Cohn an executive mortgage banker at Connecticut-based. Sep 17 2022. 15 2017 can deduct interest on the first 750000 of the mortgage.

For example if a mortgage rate is 6 APR it means the borrower will have to pay 6 divided by twelve. 2022 USDA mortgage May 17 2022 Mortgage discount points explained. Mortgage rate forecast for next week Sept.

The average rate on a 30-year fixed-rate loan jumped up to 602 according to Freddie Mac. As a guide if the Bank of England puts interest rates up by 05 that would add 56 a month to a 25-year 200000 mortgage for those on a tracker mortgage deal. Maximum interest rate 688 minimum 630.

For example if in 2017 a married couple paid 40000 in interest on a 1000000 mortgage debt and 10000 in interest on a 100000 home equity loan they used to improve their home they would be able to take a 50000 40000. Borrowers will pay more in interest this week as the average rate on a 30-year fixed-rate mortgage is 617 compared to a rate of 603 a week ago. The average for the month 654.

Claiming the mortgage interest deduction requires itemizing on your tax return. Because of interest the amount you will owe in total will be higher. For example if you take out a 200000 mortgage your beginning principal balance is 200000.

I started in journalism in September 1987 on the business desk of a newspaper. The average rate for a 15-year fixed mortgage is 540 which is an increase of 17 basis points from seven days ago. 3 hours agoWall Street Prepares for Commercial Mortgage Bond Slowdown.

The APR on a 30-year fixed is 556. Todays Mortgage Refinance Rates. See all refinance rates.

The 15 Year Mortgage Rate forecast at the end of the month 668. Over a year this would add up to 672. Bunny Jet to Family Office for 175 Million.

As of August 25 2022 experts are forecasting that the 30-year fixed-rate mortgage will vary from 5 to 6 throughout 2022.

Cash Flow Projection Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintaini Cash Flow Statement Cash Flow Statement Template

Today S Mortgage Rates In California Loan Officer Kevin O Connor

Los Angeles California Mortgage Rates Loan Officer Kevin O Connor

San Jose California Mortgage Rates Loan Officer Kevin O Connor

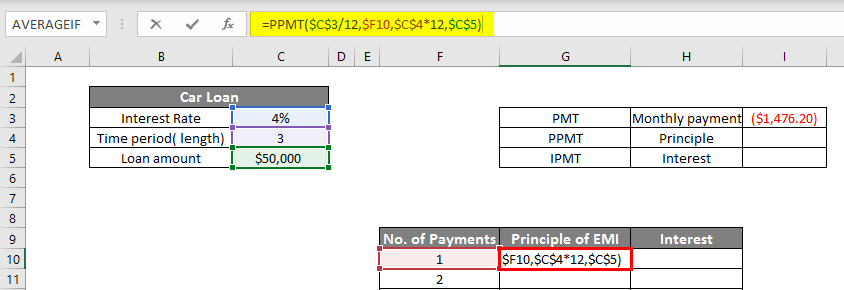

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Bpcgmu3 I Gvdm

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

San Diego California Mortgage Rates Loan Officer Kevin O Connor

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Patrick Delbuck Sr National Wholesale Account Executive Velocity Mortgage Capital Linkedin

Fresno California Mortgage Rates Loan Officer Kevin O Connor

Amortization Schedule Example Amortization Calculator Things Prepared Before Buying A Home Preparationof Homebuying Amortization Calculator Amortization Schedule Mortgage Amortization Mortgage Amortization Calculator

21 Mortgage Statistics That Come As No Surprise In 2022

Free 17 Last Will And Testament Forms Templates Word Pdf Last Will And Testament Will And Testament Words

Bluprint Home Loans Posts Facebook

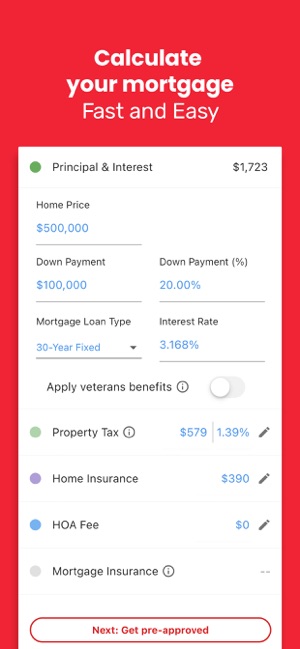

Realtor Com Mortgage On The App Store